Are You Meeting Data Security Standards?

BluVault offers a comprehensive data protection solution to help you effortlessly navigate the intricacies of evolving data protection regulations like SOX, HIPAA, and GDPR.

Why Choose BluVault?

Explore how BluVault goes above and beyond in ensuring data security excellence with advanced encryption, strict access controls, and automated audit trails.

Feel free to back up any file or folder hassle-free with BluVault. No need to worry about file types or sizes; we've got you covered. Our system can handle it all whether it's hefty PSTs, ISOs, or anything in between.

Discover a new level of security with BluVault's implementation of Zero Trust, Centralized Identity Management, secure Single Sign-On (SSO), Multi-Factor Authentication, and the Principle of Least Privilege.

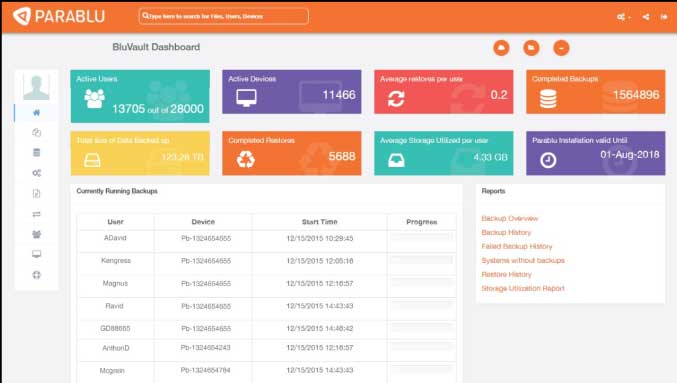

With BluVault, keeping tabs on your data has never been easier. Our built-in reports cover everything from monitoring backup status to change audits and spotting any unusual activities.

BluVault is an ISO 27001/SOC2-compliant cloud service that facilitates central management, automated backup, encryption, and more for cloud storage.

BluVault, empowers you with encryption key control. It ensures data security through robust encryption and separation of duties.

Businesses that trust Parablu

Upgrade your data compliance with Us!

Request a personalized demo. Our experts will curate a solution that suits your specific enterprise needs.

Request a Demo

10x Faster Data Recovery

Experience data recovery at unparalleled speeds – 10 times faster than any other backup vendor. Our cutting-edge technology ensures minimal operational downtime.

Delete Specific User Data

BluVault allows the deletion of specific user data from backup storage. This feature helps you comply with GDPR’s “right to be forgotten” clause.

Save on Cyber Insurance

Experience the financial benefits of robust data security with BluVault. Reduce cyber insurance premiums by 41% while prioritizing data security.

Save up to 70% on Storage Costs

Maximize savings by seamlessly backing up and storing data on your current OneDrive, reducing costs by up to 70%.

Easily Delegate Administration

BluVault streamlines task delegation to specific Administrators based on geography, department, and relevant parameters.

Testimonials to our perfection

Parablu’s unique approach to endpoint backup, which can leverage end-user cloud storage subscriptions, is a real game-changer.

Parablu's innovative approach transformed Fractal's data management strategy by delivering improved data protection, resiliency, and increased business value.

Resources

eBook

Achieve regulatory compliance with a robust backup strategy

GDPR defines, data breach as “a breach of security leading to the accidental or unlawful destruction, loss, alteration, unauthorized disclosure..

Blog

GDPR and Disaster Recovery: 3-step Guide to GDPR Compliance

While the rules and mandates are clear, clarity around what must businesses actually do to be deemed ‘GDPR-compliant’ is still poor.

Blog

Understanding GDPR

One of the highlights of 2018 was the way in which the issue of regulatory compliance was brought to the fore due to the GDPR.